Are you wondering why the renewal for your apartment building insurance for your rental building, Co-op or Condo has gone up by north of 20% ? This little primer might help explain why. The Chinese have a proverb, “may you live in interesting times”. If you’re an owner of commercial or residential real estate, especially in New York or New Jersey this proverb is an understatement. Faced with the double jeopardy challenge of escalating costs up & down your P&L in tandem with local laws capping your ability to raise rents if your units are subject to rent guidelines , finding new strategies to maintain your margins and investment yield is an imperative heading into 1st quarter to 2023. This is meant to be a primer for buyers or commercial insurance in the Metropolitan New York region. We have taken care to organize our executive summary into lines of insurance which makes the most sense.

Commercial Property Insurance :

For rental real estate , co-op’s or condominium buildings located in the metro NY region It’s all about C.O.P.E. ( Construction , Occupancy, Protection Class, Environment). When an underwriter looks at an account these are the buckets they use to organize how they will price your account. Buildings that have invested in their properties in terms of not just aesthetics ,(tenant) upgrades, but building safety & infrastructure enjoy the most competitive pricing & coverage terms. These are the items that carriers look for in the properties they underwrite.

- Sprinkler Systems ( Common Areas Good; Fully Sprinklered Best)

- Standpipe Systems

- 2nd Means of Egress .

-

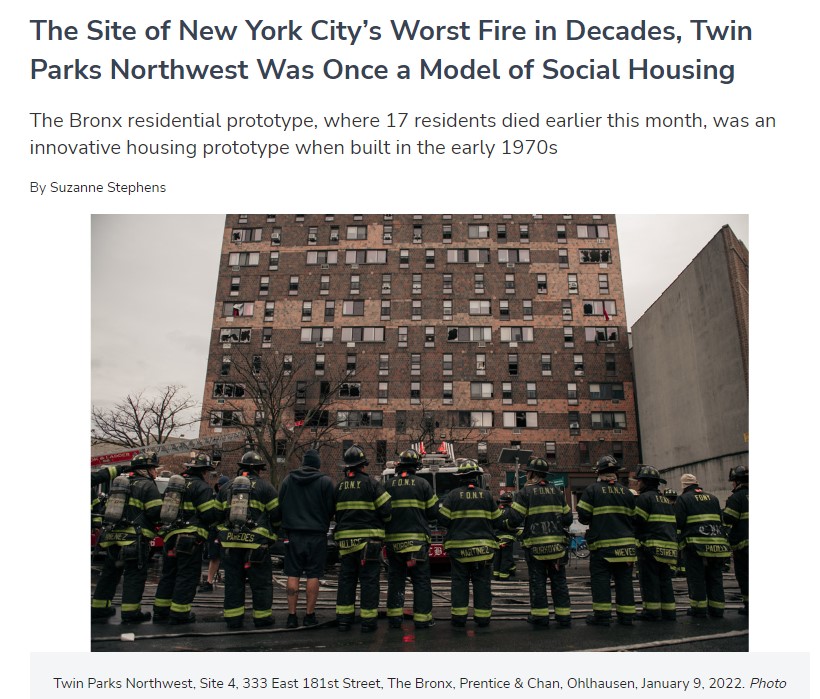

Twin Parks Fire Self Closing Fire Doors.

- Auditing of Fire Doors

- Emergency Lighting / Exit Signs

- Hard Wired Smoke Detectors

- System to document repairs, maintenance, upgrades.

- Upgraded Electrical systems

- Water Sensors & Monitors

- Boiler Sensors & Monitors

- Upgrade Schedule communicating the installation of some of the features noted above.

At Metropolitan Risk we encourage building owners to use our infra-red scanning technology to scan your building for electrical hot spots. This is a smart pro-active initiative that can save the property owner much blood & treasure by preventing an electrical fire loss up front by identifying areas of your building where the electrical system may be failing before a fire results.

The insurance carriers we see that give the owners the most credit for these features are Travelers, GNY, FM Global, CNA, AmRisk. If your building lacks many of these features they still may quote the account contingent on how well the portfolio has performed in relation to it’s COPE.

As you read this and say to yourself, jeez we have most of this stuff, yet our insurance is still increasing; or we are getting cancelled which is puzzling.

Remember when you purchase insurance through an insurance carrier, you are pooling your risk. This means you are getting lumped in with all the other buildings they are insuring. Each year the carriers, through their actuaries set the insurance companies rates based upon the losses the portfolio is incurring AND the cost of re-insurance. For some carriers it’s a double hit as their losses and re-insurance costs increase.

In the last 5 years , property losses are out passing the previous 10. Climate induced impacts are having significant cost impacts on re-insurance costs which get passed down to you the end user buyer. Remember the pooling of risk applies to the insurance carriers, not just the buyer. It’s all part of the cost food chain to transfer risk.

Many insured’s solely think about their buildings and their account performance, however the macros on the economy, portfolio loss performance , and the cost of their re-insurance contracts really dictate the cost of their property insurance. When you purchase insurance you are deeply impacted in a positive and negative way ; the “pooling of the risk”.

COMMERCIAL LIABILITY INSURANCE :

For your rental apartment building , Co-Op Building or Condominium building ,unlike Property Insurance, which is increasing nationwide due to the cost of re-insurance driven mostly by the macros detailed above; liability insurance has much larger disparities market to market, state to state, locality to locality. New York State & New York City is case in point.

On January 9th, 2022 the Twin Parks Fire sent shock waves through out the New York City Habitational Insurance market; specifically as it relates to liability. In that fire 17 people dies due to smoke inhalation. The 19 story building was rated masonry non-combust which meant it was built primarily with steel and concrete. It had multiple means of egress (ways in & out) , with fire doors protecting the egress. The challenge for the owners and the insurers was the alleged malfunction of the fire door hinges which are self-closing. Due to their alleged malfunction smoke infiltrated the building killing 17 people from smoke inhalation.

What does that have to do with me? Great question; everything. When ever the carriers see a large loss like that come into view they look inward. How many buildings are we insuring that fit that risk profile. The answer was a lot. The determination was made that because the building was NOT fully sprinklered, which would have suppressed the smoke, this type of loss could be inevitable. Thus, the takeaway away for you is that if your building is NOT 100% sprinklered, your rates are going up, by a lot, and many carriers are refusing to insure you as they don’t want a repeat of the TWIN PARKS FIRE.

Sadly, that is only one component of the increase. Due to NY’s Labor Law or the Scaffold Law which imposes strict liability on property owners for workers who fall from a height, payouts on liability claims are significantly higher in New York than almost any other state in the country.

Gallo, Vitucci& Klar who specializes in Labor Law defense. “One of the labor law hotbeds in New York is Lackawanna County in upstate NY, think Buffalo. The Labor Law affects the entire state, not just NYC. That said NYC has a concentration of taller buildings which is why there is more activity there.”

At Metropolitan Risk we wrote an E-Book to help school property owners on the risks inherent in the labor law CLICK HERE to download. For purposes of this article , just understand that the Scaffold Law continues to push insurance costs for property owners much higher in this region than in any other region in the county. Which is a large component as to why your liability insurance costs continue to rise.

EXCESS LIABILITY INSURANCE :

Similar to liability for essentially the same reasons excess liability insurance costs continue to rise with one notable exception.

The DEMISE OF THE “PROGRAM UMBRELLA” : Program Umbrella’s where essentially products where by an MGA “Managing General Agent” would purchase large limits of excess liability coverage , and then turn to retail agents and brokers and give them access to the program for their clients. For a “Premium” the agent or brokers customers could gain access to that particular Umbrella policy purchased by the MGA. Essentially giving real estate owners the ability to purchase at a discount excess liability insurance in “BULK”, getting the “BULK” discount.

As of this time last year there were north of 10 Program Umbrella’s you could bolt into , enjoying liability limits as high a $100 million dollars for your portfolio , or building. Those days are gone. While there are still a few left, the underwriting to get in is uncompromisingly strict, and the pricing discount for buying in bulk is gone.

In over 25 years of serving building owners and developers I cannot recall a more challenging market for this cohort of insurance buyers. There simply is not enough insurance carriers writing this class of risk to drive pricing back down. It’s classic supply & demand. The carriers putting out paper on the street are calling the shots as they don’t have much competition. They are getting their number because the property owners MUST purchase coverage to comply with their lenders requirements. Lender in turn need to understand the dynamics of this current market and work with their property owners to find a balance.

On top of ALL of this are the new unfunded mandates from the City of New York, New York State and the Federal Government for all types of businesses. It’s a very challenging environment to be a landlord in New York City as the income is capped, but the costs continue to escalate higher than the other side of the P&L.

There are strategies building owners can take to mitigate some of these escalations. That is fertile ground for our next article in the series.

We hope you found this piece informative. Feel free to reach out to a Risk Advisor by calling (914) 357-8444 or simply CLICK HERE.