[av_one_full first min_height=” vertical_alignment=” space=” custom_margin=” margin=’0px’ row_boxshadow=” row_boxshadow_color=” row_boxshadow_width=’10’ link=” linktarget=” link_hover=” padding=’0px’ highlight=” highlight_size=” border=” border_color=” radius=’0px’ column_boxshadow=” column_boxshadow_color=” column_boxshadow_width=’10’ background=’bg_color’ background_color=” background_gradient_color1=” background_gradient_color2=” background_gradient_direction=’vertical’ src=” background_position=’top left’ background_repeat=’no-repeat’ animation=” mobile_breaking=” mobile_display=” av_uid=’av-cgj28o’]

[av_textblock size=” font_color=’custom’ color=’#f37f1f’ av-medium-font-size=” av-small-font-size=” av-mini-font-size=” id=” custom_class=” av_uid=’av-bbhfso’ admin_preview_bg=”]

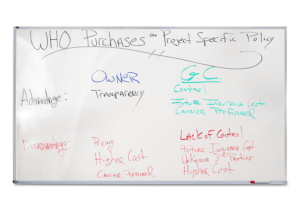

Who Purchases the Project Specific Liability Insurance Policy?

[/av_textblock]

[/av_one_full][av_one_fourth first min_height=” vertical_alignment=” space=” custom_margin=” margin=’0px’ row_boxshadow=” row_boxshadow_color=” row_boxshadow_width=’10’ link=” linktarget=” link_hover=” padding=’0px’ highlight=” highlight_size=” border=” border_color=” radius=’0px’ column_boxshadow=” column_boxshadow_color=” column_boxshadow_width=’10’ background=’bg_color’ background_color=” background_gradient_color1=” background_gradient_color2=” background_gradient_direction=’vertical’ src=” background_position=’top left’ background_repeat=’no-repeat’ animation=” mobile_breaking=” mobile_display=” av_uid=’av-8ngfmw’][/av_one_fourth]

[av_one_half min_height=” vertical_alignment=” space=” custom_margin=” margin=’0px’ row_boxshadow=” row_boxshadow_color=” row_boxshadow_width=’10’ link=” linktarget=” link_hover=” padding=’0px’ highlight=” highlight_size=” border=” border_color=” radius=’0px’ column_boxshadow=” column_boxshadow_color=” column_boxshadow_width=’10’ background=’bg_color’ background_color=” background_gradient_color1=” background_gradient_color2=” background_gradient_direction=’vertical’ src=” background_position=’top left’ background_repeat=’no-repeat’ animation=” mobile_breaking=” mobile_display=” av_uid=’av-78afwo’]

[av_video src=’https://vimeo.com/359313459′ mobile_image=” attachment=” attachment_size=” format=’16-9′ width=’16’ height=’9′ conditional_play=” id=” custom_class=” av_uid=’av-554w7s’]

[av_textblock size=” font_color=” color=” av-medium-font-size=” av-small-font-size=” av-mini-font-size=” id=” custom_class=” av_uid=’av-3xp3x4′ admin_preview_bg=”]

The decision on who purchases the project specific liability insurance policy is a raging debate usually putting competing insurance brokers arguing for their piece of the pie. IS it the owner through his broker or is it the G.C. through their broker? Both making compelling arguments. While they both have substantial skin on the game there is a reason these projects only get underwritten with the G.C.’s insurance data. If you don’t believe me try and get a project underwritten with out the G.C.’s information. Outside of the specific project information like location, materials, height e.t.c. very little historical information is asked of the owner.

The underwriters principally care about these items for the General Contractor :

- What’s the historical loss history for the last 5 to 6 years of the G.C.?

- OSHA / DOB Violations?

- Do they have a history of building similar buildings of size, scale, scope?

- In this geography?

- Financials if they have any level of self insured retention.

- What’s the org chart look like? Are they staffed properly?

- Construction Budget

[/av_textblock]

[av_textblock size=” font_color=” color=” av-medium-font-size=” av-small-font-size=” av-mini-font-size=” id=” custom_class=” av_uid=’av-2v40y2′ admin_preview_bg=”]

Click the image above for a high resolution version of the whiteboard in the video

[/av_textblock]

[av_textblock av_uid=’av-2v40y2′][/av_textblock]

[av_textblock size=” font_color=” color=” av-medium-font-size=” av-small-font-size=” av-mini-font-size=” av_uid=’av-juttjn0j’ admin_preview_bg=”]

[/av_textblock]

[/av_one_half][av_one_fourth min_height=” vertical_alignment=” space=” custom_margin=” margin=’0px’ row_boxshadow=” row_boxshadow_color=” row_boxshadow_width=’10’ link=” linktarget=” link_hover=” padding=’0px’ highlight=” highlight_size=” border=” border_color=” radius=’0px’ column_boxshadow=” column_boxshadow_color=” column_boxshadow_width=’10’ background=’bg_color’ background_color=” background_gradient_color1=” background_gradient_color2=” background_gradient_direction=’vertical’ src=” background_position=’top left’ background_repeat=’no-repeat’ animation=” mobile_breaking=” mobile_display=” av_uid=’av-30qzaw’][/av_one_fourth]